Welcome, dear readers! Let’s delve into the world of Cit Bank Joint Accounts. These accounts are a great way for couples, family members, or business partners to manage their finances together. By opening a joint account with Cit Bank, individuals can easily share expenses, deposit checks, and monitor their financial goals collectively. Understanding the ins and outs of Cit Bank Joint Accounts can help you make informed decisions about your finances. So, let’s explore the benefits and considerations of these accounts together!

What is a CIT Bank Joint Account?

A CIT Bank Joint Account is a type of bank account that allows two or more individuals to share ownership and access to the funds in the account. Joint accounts are commonly used by couples, family members, business partners, or anyone else who wants to pool their resources and manage their finances together.

When you open a joint account with CIT Bank, each account holder has equal ownership rights and responsibilities. This means that every person listed on the account can deposit or withdraw funds, monitor account activity, and make changes to the account settings. It is important to note that all account holders are legally responsible for the funds in the account, regardless of who contributed the money.

One of the main benefits of opening a CIT Bank Joint Account is the convenience it offers for managing shared expenses and savings goals. Instead of juggling multiple individual accounts, joint account holders can easily track their finances in one centralized location. This can be especially helpful for couples who are managing household expenses, parents who are saving for their children’s education, or business partners who are running a joint venture.

Another advantage of a CIT Bank Joint Account is the ability to set up automatic transfers and recurring payments for shared bills. This can help streamline the payment process and ensure that all account holders are contributing their fair share towards common expenses. Additionally, joint account holders can easily monitor each other’s spending habits and account activity to prevent any unauthorized transactions or suspicious behavior.

It is important to carefully consider who you choose to open a joint account with, as all account holders will have equal access to the funds and control over the account. While joint accounts can strengthen trust and communication among account holders, they can also lead to potential conflicts or disputes if not managed properly. It is recommended to have open and honest conversations about financial goals, spending habits, and responsibilities before opening a joint account to avoid any misunderstandings in the future.

In conclusion, a CIT Bank Joint Account is a convenient and efficient way for individuals to manage their finances together. Whether you are saving for a major purchase, splitting expenses with a partner, or running a business with a partner, a joint account can help simplify your money management and achieve your financial goals as a team.

Benefits of Opening a Joint Account at CIT Bank

Opening a joint account at CIT Bank can offer a range of benefits for you and your partner or family member. Not only does it provide a convenient way to manage your finances together, but it can also help to strengthen your relationship by fostering transparency and trust. Here are some of the key benefits of opening a joint account at CIT Bank:

1. Shared Financial Responsibilities: One of the primary advantages of a joint account is the ability to share financial responsibilities with your partner. This can make it easier to budget and pay bills together, as both of you will have access to the account and can monitor transactions in real-time. By working together to manage your finances, you can avoid potential misunderstandings and ensure that both parties are on the same page when it comes to money management.

2. Increased Saving Potential: When you open a joint account at CIT Bank, you have the opportunity to leverage both of your incomes to increase your saving potential. By pooling your resources into a single account, you can more easily reach your savings goals, whether that be saving for a down payment on a house, a vacation, or an emergency fund. Additionally, having a joint account can help to build your savings faster as you can both contribute to it regularly, ultimately leading to a stronger financial foundation for your future.

3. Enhanced Convenience: Managing your finances can be time-consuming and stressful, especially when you are doing it alone. However, with a joint account at CIT Bank, you can streamline your financial tasks and make them more convenient. Both account holders can access the account online or through the mobile app, allowing you to easily track your spending, make transfers, and pay bills without having to constantly communicate with each other about every transaction. This level of convenience can help to simplify your financial life and reduce the potential for miscommunication or oversights.

4. Improved Communication: Money is one of the major sources of conflict in relationships, but opening a joint account at CIT Bank can actually help to improve communication between you and your partner. By having a shared account, you are forced to have open and honest conversations about your financial goals, priorities, and spending habits. This can lead to better financial planning, increased trust, and a stronger bond between you and your partner. Additionally, having a joint account can encourage more frequent communication about your finances, which can ultimately lead to a healthier and more harmonious relationship.

Overall, opening a joint account at CIT Bank can be a beneficial step towards achieving your financial goals and strengthening your relationship. With shared financial responsibilities, increased saving potential, enhanced convenience, and improved communication, a joint account can help you and your partner navigate your financial journey together with confidence and transparency.

How to Open a Joint Account with CIT Bank

Opening a joint account with CIT Bank is a simple process that can be done entirely online. Here are the steps to follow:

1. Decide on the Type of Joint Account: Before opening a joint account, you need to decide the type of joint account that best suits your needs. CIT Bank offers various joint account options, including joint savings accounts, joint checking accounts, and joint CDs. Determine the type of account you want to open with your partner or family member.

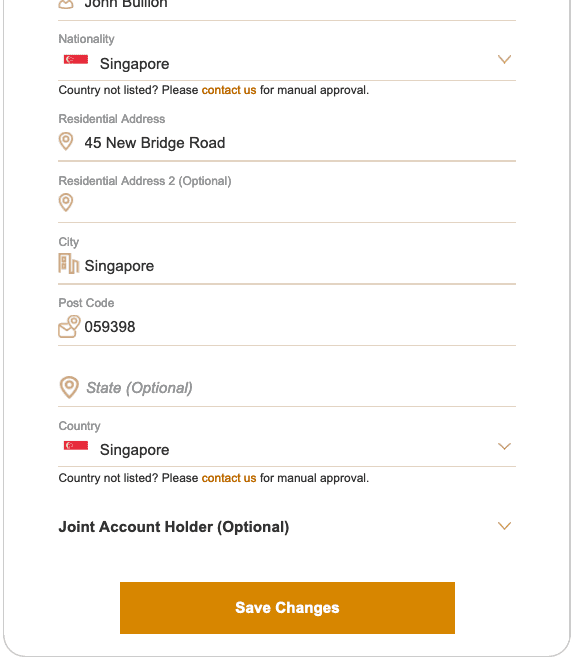

2. Gather Required Information: Before starting the online application process, make sure you have all the necessary information readily available. This may include personal details of both account holders, such as names, addresses, social security numbers, date of birth, and contact information. You will also need to provide identification documents, such as driver’s licenses or passports.

3. Fill Out the Online Application: Once you have decided on the type of joint account and gathered all the required information, visit CIT Bank’s website to start the application process. Look for the option to open a joint account and click on it. You will be prompted to provide the necessary information about both account holders and choose the type of joint account you wish to open. Make sure all the information provided is accurate and up to date. Double-check everything before proceeding to the next step.

When filling out the online application, you may be asked to agree to CIT Bank’s terms and conditions, as well as provide consent for credit checks if necessary. It is important to read the terms and conditions carefully to understand the responsibilities of both joint account holders. Once you have completed the online application, submit it for review.

4. Fund the Joint Account: After successfully submitting the online application, the next step is to fund your joint account. CIT Bank may require an initial deposit to activate the account. You can transfer funds from an existing bank account or set up a direct deposit to fund the joint account. Make sure you have enough funds to meet the minimum balance requirements and any other fees associated with the account.

5. Receive Confirmation and Account Information: Once your joint account application has been reviewed and approved, you will receive confirmation from CIT Bank. This may include account details, such as account numbers, online banking login information, and any other relevant information. You can start using your joint account to manage your finances together with your partner or family member.

Opening a joint account with CIT Bank is a convenient way to share finances and achieve common financial goals with your loved ones. Follow these steps to open a joint account smoothly and start enjoying the benefits of joint account ownership today.

Managing a CIT Bank Joint Account

Having a joint account with CIT Bank can offer convenience and flexibility for couples, family members, or business partners. Here are some tips on how to effectively manage your CIT Bank joint account:

1. Establish Clear Communication: The key to successfully managing a joint account is to establish clear communication with your account holder. Discuss expectations, spending limits, and financial goals to ensure that both parties are on the same page.

2. Set Spending Limits: To avoid any misunderstandings or conflicts, it is important to set spending limits for each account holder. This will help prevent overspending and keep track of the budget effectively.

3. Use Online Banking Tools: CIT Bank offers online banking tools that allow you to monitor your joint account activity, transfer funds, set up alerts, and manage your account from anywhere at any time. Take advantage of these tools to stay on top of your finances.

4. Designate Responsibilities: In order to effectively manage a CIT Bank joint account, it is helpful to designate responsibilities for each account holder. This can include who is responsible for paying bills, monitoring transactions, or communicating with the bank. By clearly defining roles, you can avoid confusion and ensure that all tasks are being taken care of.

For example, if one account holder is better with budgeting and tracking expenses, they can take on the responsibility of monitoring transactions and updating the budget. On the other hand, if another account holder is more organized and detail-oriented, they can handle bill payments and ensure that all financial obligations are met on time.

By dividing responsibilities, you can streamline the management of your CIT Bank joint account and make sure that all aspects of your finances are being properly taken care of. This can lead to a smoother and more efficient financial management process for both account holders.

Overall, managing a CIT Bank joint account requires clear communication, setting spending limits, utilizing online banking tools, and designating responsibilities. By following these tips, you can effectively manage your joint account and ensure that your finances are well-organized and under control.

Tips for Using a CIT Bank Joint Account Wisely

When opening a joint account with CIT Bank, there are a few tips to keep in mind in order to ensure that you are using the account wisely. By following these tips, you can make the most out of your joint account and avoid any potential pitfalls that may arise.

1. Communicate with Your Joint Account Holder

Communication is key when it comes to managing a joint account. Make sure to regularly discuss with your joint account holder about any transactions, spending limits, or financial goals. By staying open and transparent with each other, you can avoid any misunderstandings or conflicts that may arise due to miscommunication.

2. Set Financial Goals Together

It’s important to set financial goals together as joint account holders. Whether it’s saving up for a vacation, a new home, or paying off debt, having a shared goal can help you both stay motivated and on track with your finances. Make sure to discuss your goals regularly and adjust them as needed.

3. Monitor Your Account Activity

Keep a close eye on your joint account activity to ensure that everything is running smoothly. Check your account statements regularly for any unauthorized transactions or errors. By monitoring your account activity, you can spot any red flags early on and take action to resolve them.

4. Avoid Overspending

It’s easy to overspend when you have access to a joint account with another person. Make sure to set spending limits and stick to a budget to avoid any financial strain on your account. Discuss with your joint account holder about how much you can spend and make sure to track your expenses accordingly.

5. Plan for the Future

Planning for the future is essential when it comes to using a CIT Bank joint account wisely. Discuss with your joint account holder about your long-term financial goals, such as saving for retirement or investing in the stock market. Consider setting up automatic transfers to your joint account for savings or investments to help you reach your future goals.

By following these tips for using a CIT Bank joint account wisely, you can ensure that you and your joint account holder are on the same page when it comes to managing your finances. Communication, goal-setting, monitoring, budgeting, and planning for the future are all key factors in successfully using a joint account with CIT Bank.

Originally posted 2025-01-08 15:06:15.